7813 FOR LIFE GUARANTEED MINIMUM WITHDRAWAL BENEFIT WITH ANNUAL STEP-UP Thank you for choosing Jackson National Life Insurance Company®, also referred to as "the Company." This guaranteed minimum withdrawal benefit (GMWB) is made a part of the Contract to which it is attached. Certain provisions of Your Contract are revised as described below as of the Effective Date of this add-on benefit. To the extent any provisions contained in this add-on benefit are contrary to or inconsistent with those of the Contract to which it is attached, the provisions of this add-on benefit will control. The provisions of Your Contract remain in effect except where modified by this add-on benefit. PLEASE NOTE: THIS ADD-ON BENEFIT CANNOT BE TERMINATED INDEPENDENTLY FROM THE CONTRACT TO WHICH IT IS ATTACHED EXCEPT AS OUTLINED IN THE DEATH BENEFIT PROVISIONS. YOU MAY CHANGE THE OWNERSHIP OF THE CONTRACT. HOWEVER, THE DESIGNATED LIFE (AS DEFINED BY THIS ADD-ON BENEFIT) CANNOT CHANGE. ADVISORY FEE WITHDRAWALS ARE NOT PERMITTED ON CONTRACTS TO WHICH THIS ADD-ON BENEFIT IS ATTACHED. THE COMPANY ASSUMES NO RESPONSIBILITY FOR THE VALIDITY OR TAX CONSEQUENCES OF ANY OWNERSHIP CHANGE. IF YOU MAKE AN OWNERSHIP CHANGE, YOU MAY HAVE TO PAY TAXES. THE COMPANY ENCOURAGES YOU TO SEEK LEGAL AND/OR TAX ADVICE. THE COMPANY RESERVES THE RIGHT TO LIMIT ALLOCATIONS AMONG THE AVAILABLE INDEX OR FIXED ACCOUNT OPTIONS UPON ELECTION OF THIS BENEFIT. PLEASE NOTE: PARTIAL WITHDRAWALS IN EXCESS OF THE GUARANTEED ANNUAL WITHDRAWAL AMOUNT (GAWA) OR THE REQUIRED MINIMUM DISTRIBUTION (RMD) DURING THE CONTRACT YEAR MAY BE SUBJECT TO A MARKET VALUE ADJUSTMENT (MVA) AND COULD REDUCE FUTURE BENEFITS BY MORE THAN THE DOLLAR AMOUNT OF THE WITHDRAWAL. THIS ADD-ON BENEFIT PROVIDES NO CASH OR NONFORFEITURE VALUES. The Contract is revised as follows: 1) The following language is added to the DEFINITIONS of the Contract and is applicable to this add-on benefit only: All terms defined in the Contract that are used in this add-on benefit have the same definition as in the Contract. ADD-ON BENEFIT FINAL 11/15/23

7813 2 "DEFERRAL YEAR. The period of time measured by each Contract Anniversary that has passed since the Effective Date of this add-on benefit. Deferral Years stop accruing at the Determination Date. DESIGNATED LIFE. The life on which certain GMWB values are based. The Designated Life is shown on the Supplemental Contract Data Pages. If the Owner is a natural person, then the Owner is the Designated Life. For Joint Owners, the oldest Joint Owner is the Designated Life. If the Owner is a legal entity, the Annuitant is the Designated Life. If the Owner is a legal entity and there are Joint Annuitants, the oldest Joint Annuitant is the Designated Life. The Designated Life may not be changed. DETERMINATION DATE. The date the Guaranteed Annual Withdrawal Amount Percentage (GAWA%) is determined. The Determination Date is the earlier of: 1. the time of the first withdrawal after the Effective Date of this add-on benefit; 2. the date the Owner elects to opt out of automatic step-ups to avoid an increase in GMWB charge percentage; 3. the date the Contract Value reduces to zero; 4. the date the GMWB is continued by the spousal Beneficiary; or 5. the date the Life Income of the GAWA Income Option is elected. DETERMINATION DATE STEP-UP. The one-time step up of the Guaranteed Withdrawal Balance (GWB) that occurs if the Contract Value is greater than the GWB on the Determination Date. EFFECTIVE DATE. The date shown on the Supplemental Contract Data Pages. FOR LIFE GUARANTEE. A guarantee that allows You to take partial withdrawals for the lifetime of the Designated Life or, with Joint Owners, the lifetime of the Joint Owner who dies first. For a Contract owned by a legal entity with Joint Annuitants, You may take partial withdrawals for the lifetime of the Joint Annuitant who dies first. GUARANTEED ANNUAL WITHDRAWAL AMOUNT (GAWA). The maximum amount You can withdraw each Contract Year, subject to the RMD exception stated in this add-on benefit, without reducing the guaranteed amount You can withdraw in future Contract Years. GUARANTEED ANNUAL WITHDRAWAL AMOUNT PERCENTAGE (GAWA%). The percentage used to determine the GAWA. GUARANTEED WITHDRAWAL BALANCE (GWB). The value upon which the GAWA and the GMWB Charge are based." 2) The following language is revised in the DEFINITIONS of the Contract: "INTERIM VALUE. The quantity used to adjust the Index Account Option value for withdrawals, including withdrawals of the GAWA or RMD, as applicable, or an Intra-Term Performance Lock prior to the end of the Index Account Option term. The Interim Value uses prorated Index Adjustment Factor(s), where applicable, based on the elapsed portion of the Index Account Option term. For detailed information on the Interim Value, see the Crediting Method endorsements and the crediting method Supplemental Contract Data Pages.

7813 3 REQUIRED MINIMUM DISTRIBUTION (RMD). For certain Qualified Plan contracts, the RMD is the amount defined by the Internal Revenue Code and the implementing regulations as the minimum distribution requirement that applies to this Contract only. For purposes of this add-on benefit, this definition excludes any withdrawal necessary to satisfy the minimum distribution requirements of the Internal Revenue Code if the Contract is purchased with contributions from a nontaxable transfer after the death of the owner of a qualified contract." 3) The following language is added to the MISSTATEMENT OF AGE AND/OR SEX provision of the GENERAL PROVISIONS of the Contract: "If the age of the Designated Life is incorrectly stated on the Effective Date of the GMWB but falls within the allowable age range then, on the date the misstatement is discovered, the GWB and GAWA will be recalculated based on the GAWA% applicable at the correct age. If the age of the Designated Life is incorrectly stated on the Effective Date of the GMWB and falls outside the allowable age range then the GMWB will be null and void and all GMWB Charges will be refunded on the date the misstatement is discovered." 4) The following language is added to the REPORTS provision of the GENERAL PROVISIONS of the Contract: "For the current reporting period, if the GMWB is in effect, the Contract's annual report will also include: 1. the beginning and ending GWB; 2. the applicable GAWA% and the GAWA available for withdrawal in the following Contract Year; and 3. the Contract Value after the application of the GMWB Charge." 5) The following language is added to the WITHDRAWAL PROVISIONS of the Contract: "FOR LIFE GUARANTEED MINIMUM WITHDRAWAL BENEFIT. The GMWB allows You to receive annual payments of the GAWA prior to the Income Date: 1) if the For Life Guarantee is in effect, for the lifetime of the Designated Life, or, if there are Joint Owners, for the lifetime of the Joint Owner who dies first, or 2) if the For Life Guarantee is not in effect, until the earlier of Your death or the death of any Joint Owner or until the GWB is depleted, regardless of the performance of the Index Account Options or level of the Contract Value. The GAWA will not reduce if total partial withdrawals taken within each Contract Year do not exceed the greater of the GAWA or the RMD. If You do not take a withdrawal of the greater of the GAWA or the RMD in one Contract Year, You may not withdraw more than the greater of the GAWA or the RMD as a guaranteed withdrawal in subsequent Contract Years. For purposes of this add-on benefit, partial withdrawals are considered to be the entire amount withdrawn from the Contract after the Effective Date of this add-on benefit, including any applicable charges for and adjustments to such withdrawals. GAWA withdrawals are considered partial withdrawals while the Contract Value is greater than zero and affect all Contract values the same as any other partial withdrawal would. The total amount received under this guarantee may be less than the GWB at election due to the application of charges and adjustments under the Contract.

7813 4 A partial withdrawal in excess of the Withdrawal Value will be permitted as long as total partial withdrawals in the Contract Year do not exceed the greater of the GAWA or the RMD. A partial withdrawal in excess of the Contract Value will be permitted as long as total partial withdrawals in the Contract Year do not exceed the greater of the GAWA or the RMD. In this case, the Contract Value will be set to zero and the Contract Value Reduces to Zero provision will apply. Assessment of GMWB Charge. The GMWB Charge in effect on the Effective Date is shown on the Supplemental Contract Data Pages. The GMWB Charge will be deducted on a pro rata basis from all Contract Options on each Contract Anniversary, when the Fixed Account Value is greater than the Fixed Account Minimum Value, as defined in Your Contract. If the Fixed Account Value is reduced to the Fixed Account Minimum Value, the GMWB Charge will be deducted on a pro rata basis from the Index Account Options. If no value remains in the Index Account Options, and the Fixed Account Value is equal to the Fixed Account Minimum Value on any Contract Anniversary, the GMWB Charge will not be assessed for that Contract Year. The GMWB Charge will be discontinued upon the earlier of the termination of this add-on benefit or the date on which the Contract Value equals zero. Upon termination, a pro rata GMWB Charge will be assessed for the period since the last annual GMWB Charge. The Company reserves the right to increase the GMWB Charge percentage, subject to the Maximum Guaranteed Minimum Withdrawal Benefit Charge provision shown on the Supplemental Contract Data Pages. Guaranteed Withdrawal Balance. On the Effective Date of this add-on benefit, the GWB is determined as follows and is subject to the GWB Maximum shown on the Supplemental Contract Data Pages: 1. If the Effective Date of this add-on benefit is the Issue Date of the Contract, the GWB equals the Premium, net of any applicable taxes. 2. If the Effective Date of this add-on benefit is after the Issue Date of the Contract, the GWB equals the Contract Value on the Effective Date of this add-on benefit. On the Determination Date, if the Contract Value is greater than the GWB, there will be an automatic one-time Determination Date Step-Up to increase the GWB to equal the Contract Value, subject to the GWB Maximum shown on the Supplemental Contract Data Pages. Partial withdrawals will affect the GWB as follows: 1. If the partial withdrawal plus all prior partial withdrawals made in the current Contract Year is less than or equal to the greater of the GAWA or the RMD, the GWB is equal to the greater of: a. the GWB prior to the partial withdrawal less the partial withdrawal; or b. zero.

7813 5 2. If the partial withdrawal plus all prior partial withdrawals made in the current Contract Year exceeds the greater of the GAWA or the RMD: a. the excess withdrawal is defined as the lesser of the total amount of the current partial withdrawal or the amount by which cumulative partial withdrawals in the current Contract Year exceed the greater of the GAWA or the RMD, and b. the GWB is equal to the greater of: 1. the GWB prior to the partial withdrawal, first reduced dollar for dollar for any portion of the partial withdrawal not defined as an excess withdrawal, then reduced in the same proportion that the Contract Value is reduced by the excess withdrawal; or 2. zero. The GWB may not be withdrawn as a lump-sum and is not payable as a death benefit. Guaranteed Annual Withdrawal Amount. On the Effective Date of this add-on benefit, the GAWA% is defined according to the table on the Supplemental Contract Data Pages. The GAWA% is determined on the Determination Date. The GAWA% is based on the Designated Life's attained age on the Determination Date and the elapsed Deferral Years, as shown on the Supplemental Contract Data Pages. Prior to the Determination Date, the applicable GAWA% for each attained age band will increase based on the number of elapsed Deferral Years, as shown on the Supplemental Contract Data Pages. Once determined, the GAWA% will not subsequently change. On the Determination Date, the GAWA is equal to the GAWA% determined by the Designated Life's attained age and elapsed Deferral Years shown on the Supplemental Contract Data Pages, multiplied by the GWB. If the Contract Value is greater than the GWB on the Determination Date, the GWB will automatically step up to the Contract Value prior to determination of the GAWA. Partial withdrawals will affect the GAWA as follows: 1. If the partial withdrawal plus all prior partial withdrawals made in the current Contract Year is less than or equal to the greater of the GAWA or the RMD, the GAWA will be unchanged. 2. If the partial withdrawal plus all prior partial withdrawals made in the current Contract Year exceeds the greater of the GAWA or the RMD, the excess withdrawal is defined as the lesser of the total amount of the current partial withdrawal or the amount by which cumulative partial withdrawals in the current Contract Year exceed the greater of the GAWA or the RMD, and the GAWA is reduced in the same proportion as the Contract Value is reduced by the excess withdrawal. At the end of each Contract Year after the GAWA has been determined, if the For Life Guarantee is not in effect and the GWB is less than the GAWA, the GAWA is set equal to the GWB. For Life Guarantee. The For Life Guarantee becomes effective on the For Life Guarantee Effective Date shown on the Supplemental Contract Data Pages unless: 1. the Contract has terminated; 2. the Contract Value is reduced to zero before the For Life Guarantee Effective Date; 3. the Income Date precedes the For Life Guarantee Effective Date; or 4. the Designated Life or any Joint Owner dies before the For Life Guarantee Effective Date.

7813 6 If the For Life Guarantee becomes effective after the Determination Date, the GAWA is reset to equal the GAWA% multiplied by the current GWB. The For Life Guarantee is terminated when this GMWB is terminated or if this GMWB is continued by a spousal Beneficiary or spousal Joint Owner. Contract Value Reduces to Zero. If the Contract Value is reduced to zero as the result of a partial withdrawal which is not considered an excess withdrawal, or due to the deduction of charges, all rights under the Contract cease, all other add-on benefits are terminated without value, and Spousal Continuation is not available upon the death of the Owner or the death of any Joint Owner. If the GAWA% has not yet been determined, it will be set at the GAWA% corresponding to the Designated Life's attained age and the elapsed Deferral Years shown on the Supplemental Contract Data Pages at the time the Contract Value reduces to zero. The GAWA will be equal to the GAWA% multiplied by the GWB. If the For Life Guarantee is in effect, You will receive annual payments of the GAWA until the death of the Designated Life or the death of any Joint Owner. If the For Life Guarantee is not in effect, You will receive annual payments of the GAWA. With each payment, the GWB is reduced by the dollar amount of the payment until the GWB is depleted. The last payment will not exceed the remaining GWB at the time of payment. You will receive payments until the earlier of: 1. the depletion of the GWB; 2. the death of the Designated Life, unless that death occurred before the Contract Value reduced to zero; 3. the death of any Joint Owner; or 4. the death of the surviving spouse, if a Spousal Continuation occurred before the Contract Value reduced to zero. Upon a death or the depletion of the GWB, all payments will cease. No death benefit will apply. Subject to the Company's approval, You may elect to receive payments more frequently than annually. However, the total of the payments made during any Contract Year may not exceed the GAWA. Guaranteed Withdrawal Balance Step-Up. On each Contract Anniversary following the Effective Date of this add-on benefit, the GWB will automatically step up to equal the Contract Value if the Contract Value is greater than the GWB and You have not opted out of step-ups to avoid an increase in the GMWB Charge percentage. On the Determination Date, if the Contract Value is greater than the GWB, there will be an automatic one-time Determination Date Step-Up to increase the GWB to equal the Contract Value. This one-time Determination Date Step-Up will occur even if You have opted out of step-ups to avoid an increase in the GMWB Charge percentage. At the time of any step-up, the GWB will be increased to equal the Contract Value, subject to the GWB Maximum shown on the Supplemental Contract Data Pages. A step-up will never increase the GWB to a value higher than the GWB Maximum.

7813 7 If the step-up occurs after the Determination Date, the GAWA is recalculated and is equal to the greater of: 1. the GAWA% multiplied by the new GWB; or 2. the GAWA prior to the step-up." 6) The following language is added to the PARTIAL WITHDRAWAL provision of the WITHDRAWAL PROVISIONS of the Contract: "Withdrawals of the GAWA or any applicable RMD are not subject to MVA. Withdrawals greater than the GAWA or the RMD in a Contract Year that also exceed the MVA Free Withdrawal amount may be subject to an MVA, if applicable." 7) The following language is revised in the PARTIAL WITHDRAWAL provision of the WITHDRAWAL PROVISIONS of the Contract: "Partial withdrawals will affect the Contract Value as follows: 1. The Minimum Contract Value remaining after a partial withdrawal shown on the Contract Data Pages of the Contract will be waived. 2. The Minimum partial withdrawal amount shown on the Contract Data Pages of the Contract will be waived." 8) The following language is added to the ADVISORY FEE WITHDRAWALS provision of the WITHDRAWAL PROVISIONS of the Contract: "Advisory Fee Withdrawals are not permitted on Contracts to which any Add-On Guaranteed Minimum Withdrawal Benefit is added." 9) The following language is added to the DEATH BENEFIT PROVISIONS of the Contract: "Upon Your death or the death of any Joint Owner, while the Contract is still in effect with a Contract Value greater than zero, the GMWB terminates without value, unless the Contract is continued by the spouse. Upon continuation of the Contract by a spousal Joint Owner or a spousal Beneficiary, the spouse may elect to terminate the GMWB on the continuation date. Thereafter no GMWB Charge will be assessed. If the surviving spouse elects to terminate the GMWB upon continuation of the Contract, the surviving spouse may elect a new GMWB on any future Contract Anniversary, subject to availability. If the spouse does not make an election to terminate on the continuation date, the GMWB will be continued by the spouse and may not be subsequently terminated independently from the Contract to which it is attached. If the GMWB is continued by the spouse, the For Life Guarantee will no longer be in effect. If the GAWA% has not yet been determined, it will be set at the GAWA% corresponding to the Designated Life's attained age and the elapsed Deferral Years on the continuation date. The GAWA will be equal to the GAWA% multiplied by the GWB. If the Contract Value is greater than the GWB on the continuation date, the GWB will automatically step up to the Contract Value prior to determination of the GAWA. Once determined, the GAWA% will not subsequently change. No other adjustments will be made to the GWB or the GAWA at the time of such continuation.

7813 8 Step-ups will continue as described under the GWB Step-Up provision. Contract Years and Contract Anniversaries will continue to be based on the anniversary of the original Contract's Issue Date and the Effective Date of this add-on benefit will not change." 10) The following language is added to the INCOME PROVISIONS of the Contract: "LIFE INCOME OF THE GAWA. This option is only available if the For Life Guarantee is in effect on the Latest Income Date. You are entitled to receive payments of a fixed dollar amount during Your lifetime (with Joint Owners, the lifetime of the Joint Owner who dies first). All payments end upon Your death or the death of any Joint Owner. The total annual amount payable under this Income Option will equal the GAWA in effect when this Income Option is elected. If the GAWA% has not yet been determined, it will be set at the GAWA% corresponding to the Designated Life's attained age and elapsed Deferral Years at the time of election of this GMWB Income Option and the GAWA will be equal to the GAWA% multiplied by the GWB. If the Contract Value is greater than the GWB on the Determination Date, the GWB will automatically step up to the Contract Value prior to determination of the GAWA. This amount will be paid in the frequency that You elect, which may not be less frequently than annually. SPECIFIED PERIOD INCOME OF THE GAWA. This option is only available if the For Life Guarantee is not in effect on the Latest Income Date. You are entitled to receive payments of a fixed dollar amount for a stated number of years. The actual number of years that payments will be made is determined on the Latest Income Date by dividing the GWB by the GAWA. Upon each payment, the GWB will be reduced by the dollar amount of the payment. The total annual amount payable under this Income Option will equal the GAWA in effect when this Income Option is elected, but no payment will exceed the remaining GWB at the time of payment. This amount will be paid over the determined number of years in the frequency that You elect, which may not be less frequently than annually. If payments have been made for less than the stated number of years upon Your death or the death of any Joint Owner, the remaining payments will be made to the Beneficiary. This Income Option may not be available on certain Qualified Plans." TERMINATION OF THE GMWB. When the GMWB terminates, a pro rata GMWB Charge will be deducted from Your Contract Value for the period since the last annual GMWB Charge, and all benefits under this and any other add-on benefits end on the earlier of: 1. the date You elect to receive income payments under the Contract; 2. the Latest Income Date; 3. the date You take a total withdrawal; 4. the date upon which the Contract terminates because the Owner or any Joint Owner dies, unless continued by the spouse; 5. the continuation date if the spouse elects to terminate the GMWB; or 6. the date upon which all obligations for payment under this add-on benefit have been satisfied after the Contract has been terminated. Signed for the Jackson National Life Insurance Company President

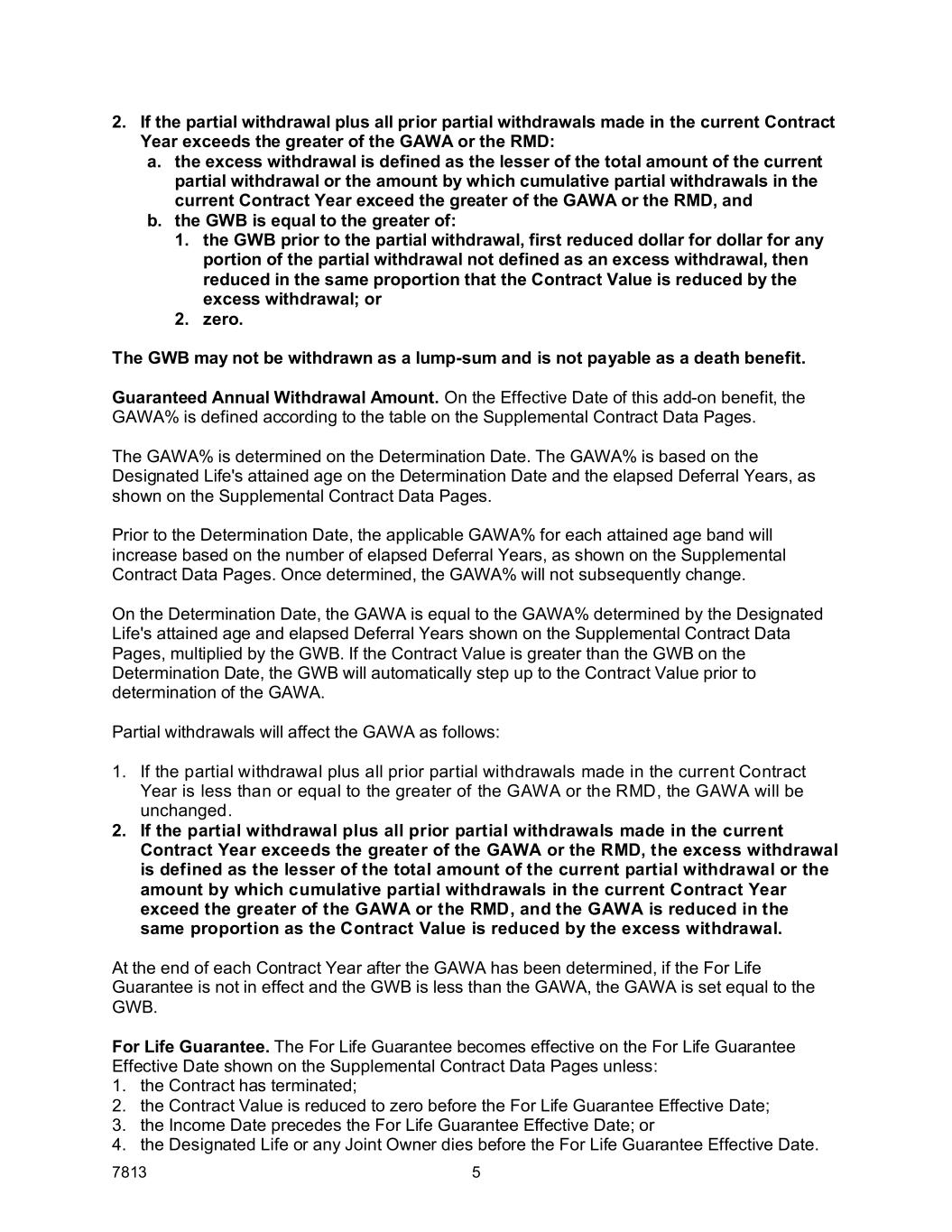

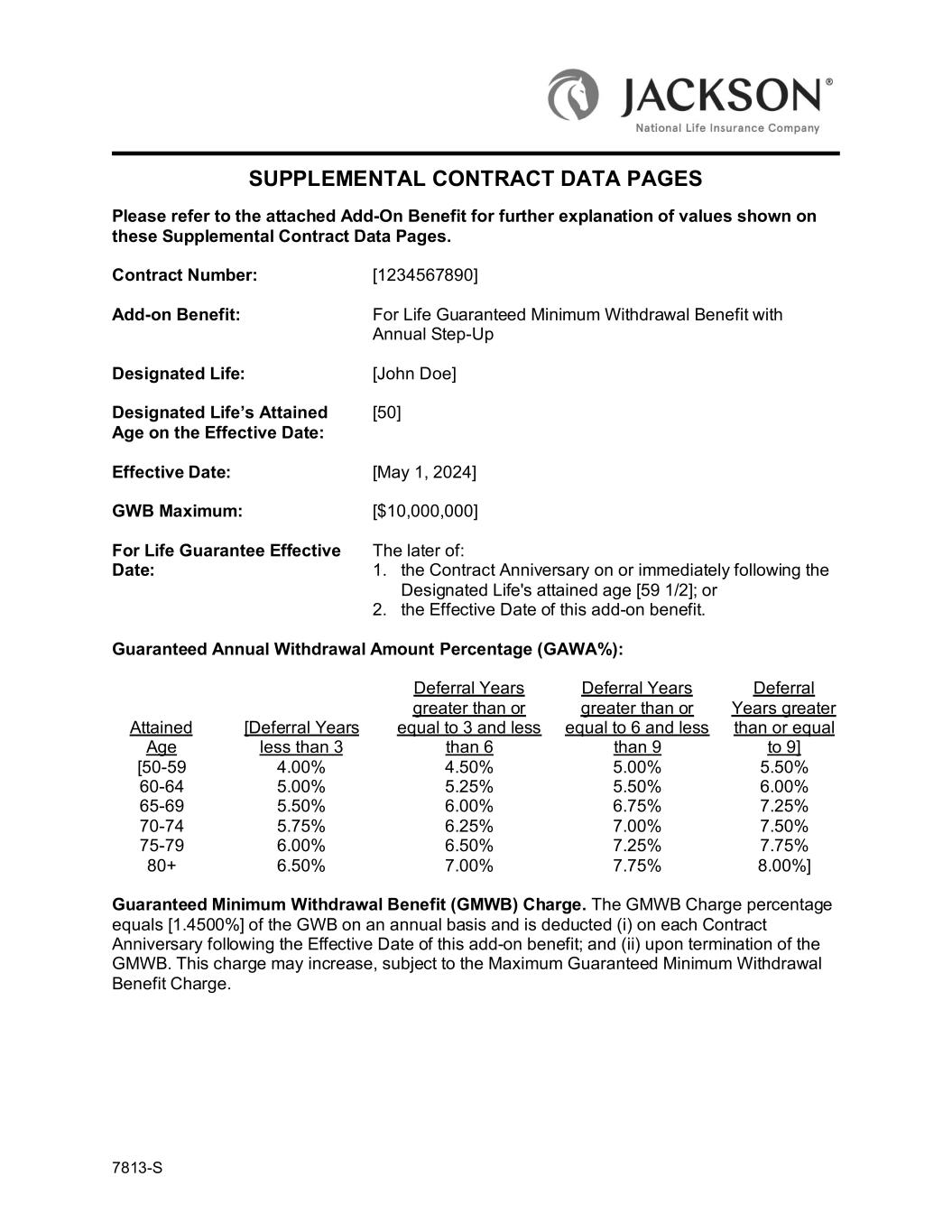

7813-S SUPPLEMENTAL CONTRACT DATA PAGES Please refer to the attached Add-On Benefit for further explanation of values shown on these Supplemental Contract Data Pages. Contract Number: [1234567890] Add-on Benefit: For Life Guaranteed Minimum Withdrawal Benefit with Annual Step-Up Designated Life: [John Doe] Designated Life’s Attained Age on the Effective Date: [50] Effective Date: [May 1, 2024] GWB Maximum: [$10,000,000] For Life Guarantee Effective Date: The later of: 1. the Contract Anniversary on or immediately following the Designated Life's attained age [59 1/2]; or 2. the Effective Date of this add-on benefit. Guaranteed Annual Withdrawal Amount Percentage (GAWA%): Attained Age [Deferral Years less than 3 Deferral Years greater than or equal to 3 and less than 6 Deferral Years greater than or equal to 6 and less than 9 Deferral Years greater than or equal to 9] [50-59 4.00% 4.50% 5.00% 5.50% 60-64 5.00% 5.25% 5.50% 6.00% 65-69 5.50% 6.00% 6.75% 7.25% 70-74 5.75% 6.25% 7.00% 7.50% 75-79 6.00% 6.50% 7.25% 7.75% 80+ 6.50% 7.00% 7.75% 8.00%] Guaranteed Minimum Withdrawal Benefit (GMWB) Charge. The GMWB Charge percentage equals [1.4500%] of the GWB on an annual basis and is deducted (i) on each Contract Anniversary following the Effective Date of this add-on benefit; and (ii) upon termination of the GMWB. This charge may increase, subject to the Maximum Guaranteed Minimum Withdrawal Benefit Charge.

7813-S 2 Maximum Guaranteed Minimum Withdrawal Benefit Charge. On each [5th] Contract Anniversary following the Effective Date of this add-on benefit, the Company reserves the right to increase the GMWB Charge percentage by up to [0.2500%] on an annual basis. The Maximum GMWB Charge percentage is [3.0000%] on an annual basis. If the GMWB Charge percentage is increased, Written Notice will be provided to You [45] days prior to the Contract Anniversary on which the GMWB Charge percentage is scheduled to increase. You may elect to opt out of the current and any future GMWB Charge percentage increases by forfeiting automatic step-ups on future Contract Anniversaries. Such election is final and must be received in Good Order prior to the Contract Anniversary on which the GMWB Charge percentage is scheduled to increase.